Find correlated stocks

Pick a period then. Its pretty rare to find stocks or indeed financial securities that are negatively correlated but its certainly not impossible.

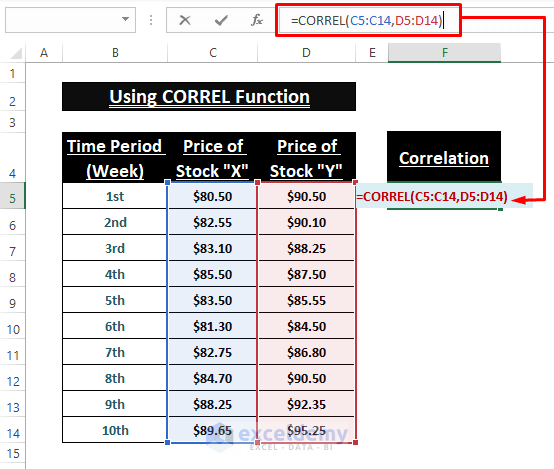

How To Calculate Correlation Between Two Stocks In Excel 3 Methods

This asset correlation testing tool allows you to view correlations for stocks ETFs and mutual funds for the given time period.

. You can decide the threshold by trial. Every day we calculate more than 21000000 correlations yes 21 million among assets all over the world. The exact relationship between stocks is expressed on a scale from -10 to 10.

How do you find the correlation of a stock To find the influence between two stocks you need to find the average price of each. For example if you want to find stocks that most closely move with Apple APPL type AAPL in the Ticker field and press Search. The Top 20 most positively correlated stocks will be.

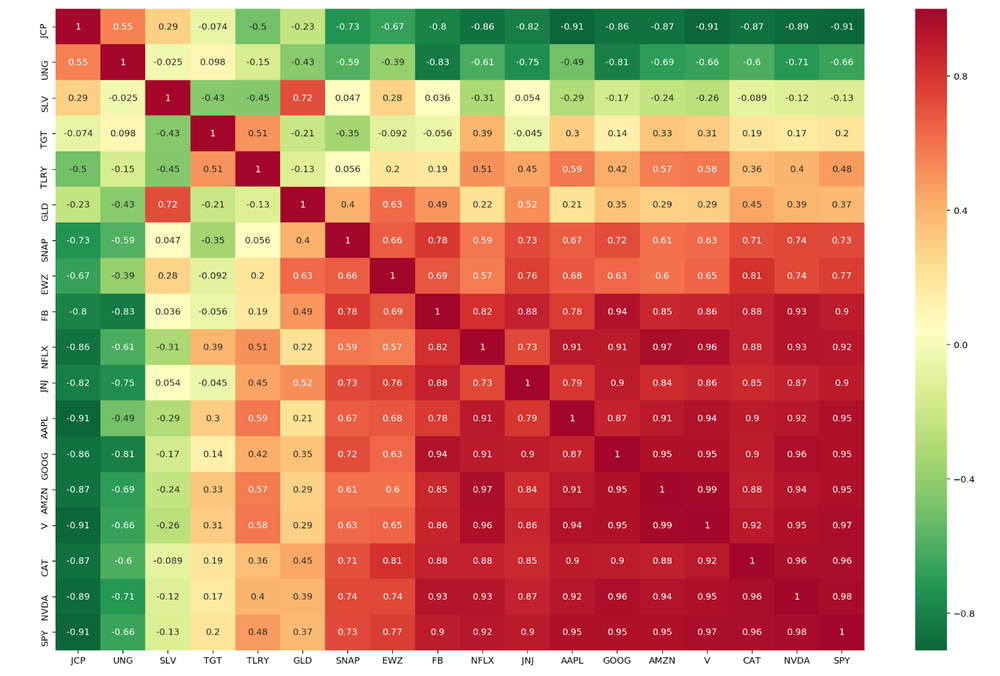

The index is the date. You also view the rolling correlation for a given number of. Youll be able to create heatmaps and various other charts showing stock correlations.

From the Dashboard click on the word Analytics in the black bar at the top of the screen this will open a drop-down menu with Correlation. Simply put stocks have fantastic momentum in most intraday moves. What is an example of a highly correlated stock.

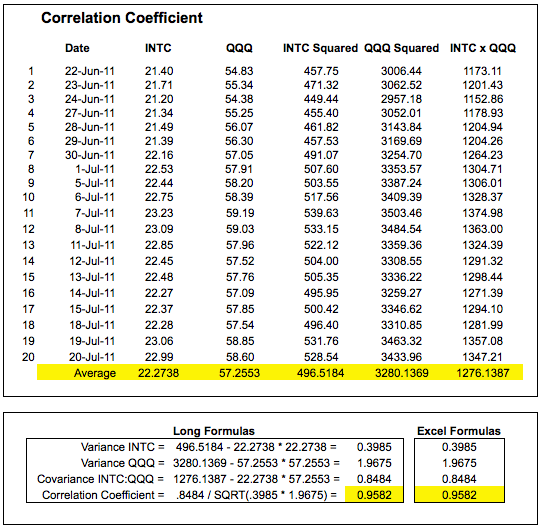

For example if two. When two stocks increase together and decrease together at the exact same rate they have a perfect positive. We will walk thru the formula which is not as ugly as it.

Top 1000 Most and Least correlated assets on the market. But its particularly rare we would argue borderline impossible to. Filter highly correlated stocks We calculate correlation of every stock with every other stock in FO list and then filter all correlations above a threshold.

To find a correlation between two stocks you can start by determining the average affordability of each. A volatile stock simply means that it is moving. Free stock market info Stock Correlation Calculator Use the Stock Correlation Calculator to compute the correlation coefficient for any stock exchange-traded fund ETF and mutual fund.

First log in to your HiddenLevers account. We can now calculate the linear correlation between each stock using. It also has several scans which allow you to search for stocks that meet your requirements in terms of.

We will walk through the formula which is not as ugly as. And from all of these. Pick a period then shuffle each stocks.

Each column is the daily return of a stock whose name is the name of the column. Stock Correlation will give you the top 20 most highlyinversely correlated tickers. Using the Pearson Correlation Coefficient we can determine whether two stocks correlate with each other.

Find top correlated stocks with any ticker you choose.

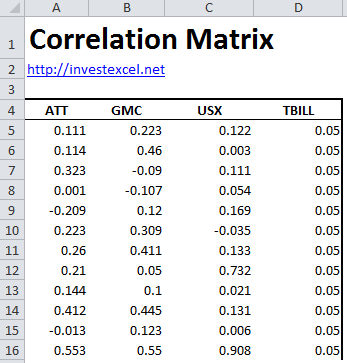

Correlation Matrix Guide And Spreadsheet For Investors

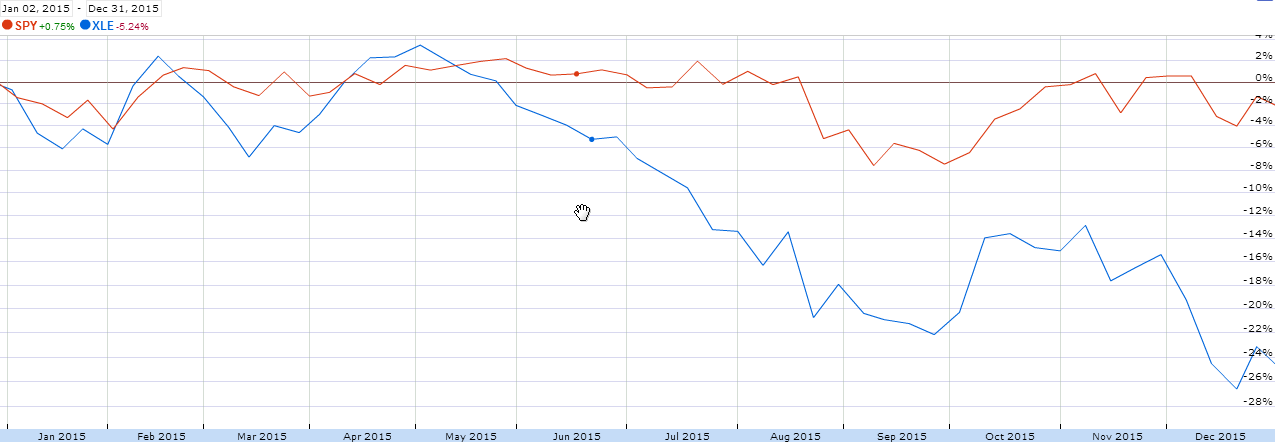

U S Stock Market Sectors Correlations Seeking Alpha

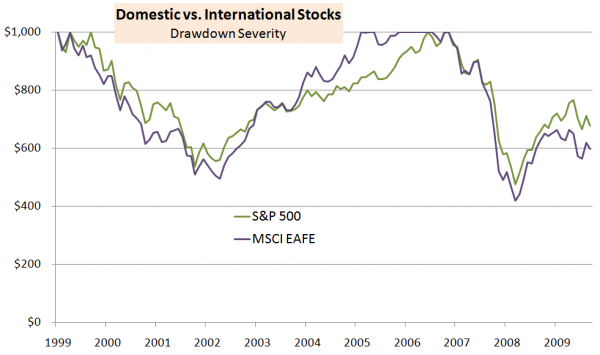

How To Use The Correlation Coefficient To Build A Diverse Portfolio Tpa

Diversification 10 Investments That Don T Correlate With The S P Seeking Alpha

Risk Part 4 Correlation Matrix Portfolio Variance Varsity By Zerodha

How To Calculate Stock Correlation Coefficient 12 Steps

What Is Stock Correlation And How Do You Find It Smartasset

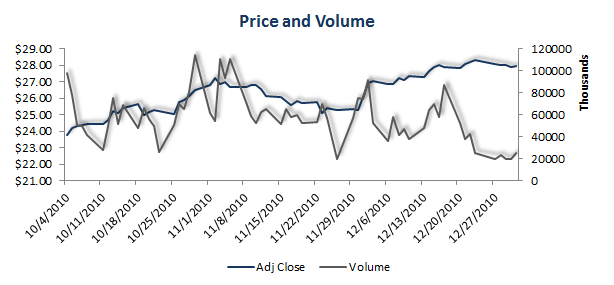

Price And Volume Correlation Seeking Alpha

Easily Visualize The Correlation Of Your Portfolio In Python

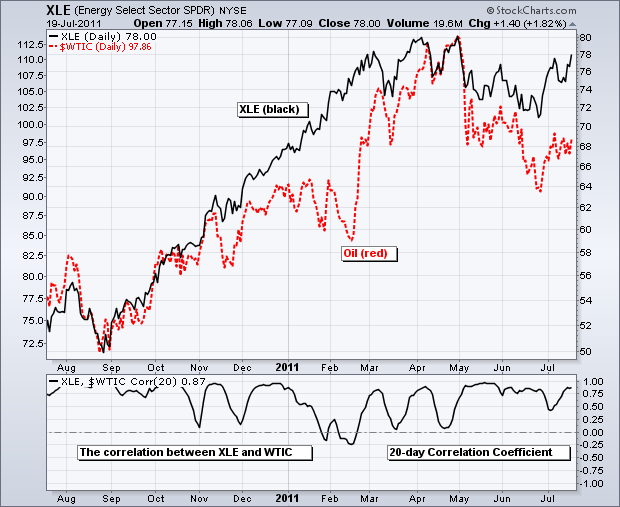

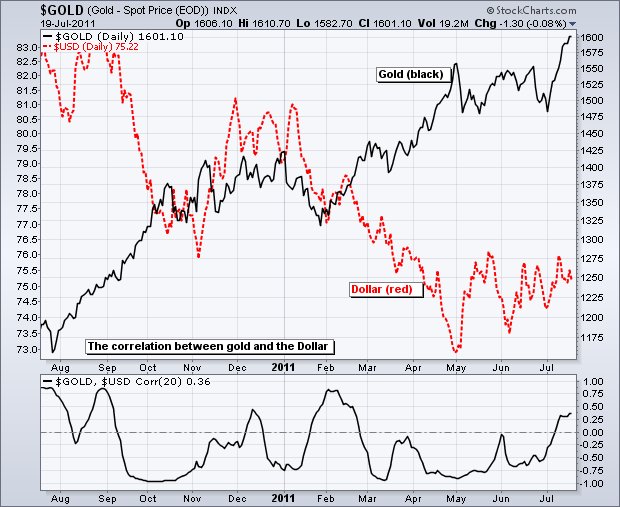

Correlation Coefficient Chartschool

Correlation Coefficient Chartschool

How To Calculate Stock Correlation Coefficient 12 Steps

How To Calculate Stock Correlation Coefficient 12 Steps

Correlation Coefficient Chartschool

What Is Stock Correlation And How Do You Find It

How To Find Correlated Stocks And Alpha Beta Values Edgerater Academy

Correlation Formula How To Calculate Step By Step